The Ins & Outs About Consolidating Debts

When you consider the availability of personal loans, car loans, mortgages and credit cards, it is not difficult to accumulate significant debt. In the current challenging times, many people are struggling to cover minimum monthly payments on individual debt arrangements. Consequently, more people are now looking at consolidating debts as a means of regaining control.

What does it mean to consolidate a debt?

Many people will have an array of individual finance arrangements which require a minimum monthly repayment. Sometimes the accumulation of these minimum repayments can place pressure on your finances. Missing just one repayment can lead to additional fees and an increase in interest charges. While many people tend to bury their head in the sand, if you can see financial difficulties on the horizon you should take action immediately.

Consolidating debt will not reduce your overall debt but it will become more manageable. Rather than having a number of different arrangements, different loan terms, interest payments and minimum repayments, these are all converted into one loan. Dependent upon your financial circumstances, you may have flexibility with regards to the repayment term. If you are struggling in the short-term, extending the repayment term will reduce your monthly repayments. However, this will mean an increase in overall interest charged.

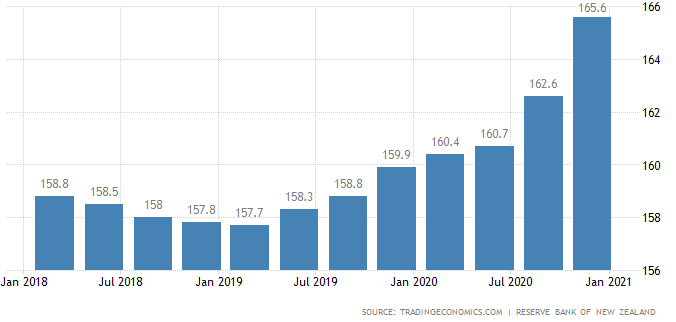

For many people, the opportunity to consolidate their debts into one manageable arrangement allows them to not only regain control of their finances but also their life. As you will see from the chart below, there has been a gradual increase in household debt as a percentage of household income in New Zealand. As of January 2021, average household debt in New Zealand was a staggering 165.6% of household income!

New Zealand household debt income

Source: Tradingeconomics.com

What happens when you consolidate your debts?

Here at Alternate Finance we can advise you about the best course of action when looking to consolidate your debts. As a responsible lender, we will be honest and upfront regarding your financial situation and whether debt consolidation is the right move. Assuming you are in a position to make regular monthly repayments, the process of consolidating your debts is relatively straightforward.

Taking into account the term of existing loans, the interest charged and affordable monthly repayments, we can calculate the level of finance required to consolidate existing debts. Once your consolidation loan has been approved, funds will be paid into your bank account, allowing you to repay existing debts in full. This will result in one consolidated loan, one monthly repayment and a repayment term which best suits your financial situation.

For some there is a temptation to pay off their debt consolidation loan as quickly as possible, you need to be sensible. If you were to default on your debt consolidation loan repayments, this would leave very few options to address your financial challenges. Those who decide on extended repayment terms will have more disposable income in the short-term. If the situation was to improve, they could always increase monthly repayments and reduce the loan term. Starting with a relatively low monthly repayment figure gives you the option to increase repayments in the future.

Is debt consolidation a good way to get out of debt?

For many people, debt consolidation can be an effective means of retaking control of their finances. It is not just a good way to get out of debt but it can be the only way other than bankruptcy and other more formal arrangements. When looking at your financial situation, it is important to take everything into account. Debts, savings, income, assets and potential changes to your income in the short, medium and longer term.

Some people may have assets to sell which could raise sufficient funds to pay down some of their outstanding debts and avoid a debt consolidation loan. However, the majority of those who seek consolidation of their debts will have limited assets and an income shortfall. The interest rate charged will reflect their financial situation at that moment in time. Consequently, when looking to address your financial difficulties it is important to act sooner rather than later. The longer you leave it, the more repayments you miss, the greater the impact on your credit rating.

Unfortunately, many people have a tendency to bury their head in the sand and hope that everything will go away. Where your finances have already started to slide, it is unlikely they will recover without taking action, such as debt consolidation.

Does consolidation ruin your credit?

There is a general misconception that debt consolidation arrangements will “ruin your credit”. This is not always the case. If you believe that you will encounter financial issues in the future, and take action, the impact on your credit score will be minimal. It is important to take action before you start missing payments, before your debt starts spiralling out of control.

Unfortunately, many people who enquire about debt consolidation will already have begun to miss repayments. Consequently, before they even approach us they will likely have seen a downturn in their credit score. However, not all hope is lost!

The quicker you can address your financial difficulties, avoid further missed payments and retake control of your finances, the quicker your credit rating will recover. Even those who have taken action before missing payments may see a slight weakening of their position in the early days of a consolidation loan. Consolidating what can often be significant debts may increase your utilisation factor, the level of debt taken on compared to the maximum for your situation. However, as you pay down your consolidation loan, your credit score will stabilise and eventually begin to recover.

How do I combine all debts into one payment?

When looking at consolidation loans, it is important that you amalgamate all of your outstanding debts under one manageable loan. Some people have a tendency to pick and choose the debts they wish to consolidate, which can defeat the point, leaving more than one minimum monthly payment. Prior to finalising the consolidation loan, you will need to approach each finance provider for a repayment figure. Once the figures for all outstanding debt arrangements have been obtained, the debt consolidation loan will be finalised and funds paid direct into your bank account.

Then, it is simply a case of paying off your existing loans leaving you with one monthly repayment. The process of facing up to your debts and arranging a consolidation loan can be daunting. Here at Alternate Finance we take our responsibilities extremely seriously, providing advice and guidance every step of the way. If you have any questions or queries, it is important to ask them sooner rather than later to avoid any confusion further down the line.

Do debt consolidation loans go into your bank account?

Many people automatically assume that funds raised via a debt consolidation loan are automatically used to repay outstanding debts. This is not the case. Upon the processing of your consolidation loan, the funds will be paid into your bank account almost immediately. It is the individual’s responsibility to use those funds to repay outstanding debts, as agreed, to regain control of their finances. Failure to do so will see the individual’s financial situation deteriorate even further and there may be serious repercussions.

Do debt consolidation loans typically work?

So long as the individuals involved are honest and upfront about their financial situation, challenges faced and future liabilities, there is no reason why a debt consolidation loan will not work. In many cases we will work backwards to calculate affordable monthly repayment figures. This calculation will take into account income, expenses and areas where there may be potential to save money in the short to medium-term. Once an affordable monthly repayment figure has been agreed, this will be used to calculate the term of the loan.

The sooner you address your financial issues, the more options available and the greater the chance that a consolidation loan will work. As responsible lenders, we will be honest and upfront about your situation and the options available. We expect the same degree of honesty in return.

What are the risks of debt consolidation?

One of the more common challenges associated with debt consolidation is that you are unable cover future monthly repayments. It may be that your income has reduced, expenses increased or health issues could impact your ability to work in the short to medium-term. Consequently, it is important to include a degree of headroom between your monthly repayments and the maximum that you could afford. This would introduce a degree of leeway which would accommodate a reduction in your income without impacting your ability to cover monthly repayments.

However, for many people the greatest risk is that they are unable, or unwilling, to change their spending habits which led to their near financial downfall. Without a change in your lifestyle, expenditure and ability to create income, a debt consolidation loan is simply a sticking plaster covering a gaping wound.

Why debt consolidation is a bad idea?

As we touched on above, one of the main challenges for many people is the need to change their spending habits and take more control of their financial affairs. There is no point in taking on a debt consolidation loan without changing the way you manage your finances. Some people fear that debt consolidation could be a bad idea for those unwilling to make changes, simply kicking the problem further down the road at often greater expense.

Rest assured, we only advise clients to take up debt consolidation loans if this is in their best interest. There is no point us reviewing your finances, calculating minimum repayments and loan terms, if this arrangement is simply unaffordable. For those who do not qualify for debt consolidation, there are other options available which we can advise upon.

Summary

There are many pros and cons as well as misconceptions regarding debt consolidation loans. It is important that you know the ins and outs about consolidating debts, your obligations and the limited options available if you fail to maintain monthly repayments. As a responsible lender, here at Alternate Finance we will be honest and upfront about your situation and the best course of action for you. However, the sooner you address your financial challenges the better for your future!