The considerable difference paying $5 extra per week off loans makes

When looking at how to reduce debt, it is vital to appreciate how loan interest is calculated. It is also essential to recognise the impact of relatively small additional regular payments on the total interest paid and the loan term. There will be situations where individuals are not able to make extra repayments. However, it can be beneficial to make additional repayments when considering how to reduce debt and get your finances back on an even keel as quickly as possible.

Calculating loan interest

When looking at loan interest and weekly repayments, it is vital to recognise the impact of compounding interest. In simple terms, compounding interest is the practice where interest is charged and added to the account regularly. This could be daily, weekly, monthly, quarterly or annually. The more frequently interest is calculated and added to your balance, the greater the element of interest on interest going forward.

Over the last few years, we have seen a significant tightening of financial regulations for consumers. Consequently, all financial products are now more transparent than ever before as potential customers need to be aware of the finer details. Here at Alternate Finance, we are positioned between the traditional banks and the high-interest payday lenders. We prefer to mould loan arrangements around the needs of clients and their financial situation at the time. It is very important to find a balance so that customers can begin to rebuild their credit ratings and financial status.

Periodic interest rate

The periodic interest rate is a relatively simple calculation that takes into account the impact of interest on interest going forward. The following calculations will give you an idea of the impact on the basic comparison interest rate, the advertised loan rate. The comparison interest rate is an adjustment of the headline interest figure, taking charges added to your loan into account. The most common cost is a setup fee, but you will be made aware of this once you start talking to a potential lender.

Before we go any further, it is helpful to look at the periodic interest rate formula:-

Comparison interest rate/number of interest rate periods in one year = Periodic rate

(1 + periodic rate ^ number of interest rate periods in one year) – 1 = Periodic interest rate

While the calculation may look a little complicated, it is relatively simple in practice, as we have shown below:-

Example: 15% (0.15 expressed as a decimal) interest rate with loan interest added every three months (4 interest charging periods per year)

Periodic rate: 0.15/4 = 0.0375 (this is the pro rata interest rate charged every three months)

Periodic interest rate calculation: 1+0.0375 ^ 4 = 1.158650

Periodic interest rate: 15.865%

As the interest on this particular loan is added to the balance every three months, the impact of interest on interest over the year increases the loan interest rate to 15.865%. This equates to just 15% if interest is added annually, i.e. there is only one interest rate charging period. To give you figures to compare and contrast, we have calculated the periodic interest rate when interest is charged every:-

Six months: 15.5625%

Month: 16.07545%

Week: 16.15834%

Day: 16.17984%

When looking at how to reduce debt, the best way is to make additional repayments where possible. This will bring down the outstanding capital value, and ultimately you will pay less interest on interest in the future.

Loan repayment comparisons

To compare and contrast the impact of extra payments each month towards your loan, we will assume the following scenario:-

Interest charge: Daily

Loan repayments: Weekly

Term: 3 years

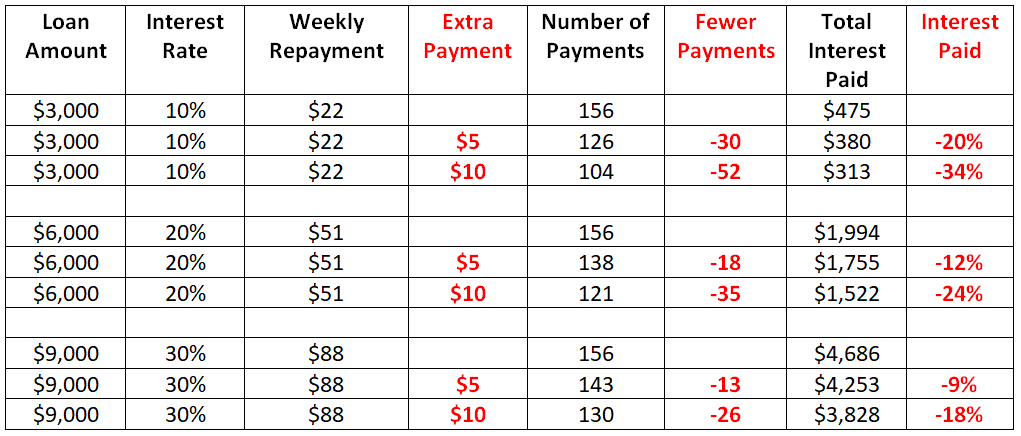

As you can see, we have used three different loan amounts and three different interest rates to highlight the impact of extra payments. Any regular extra payments you make will reduce the interest paid and the number of actual payments. Who would have guessed that such a relatively small increase in monthly payments could make such a difference?

As you will see from the table above, there are significant interest savings to be made if you’re able to pay an extra five dollars or even $10 per week towards your loan repayments. The greater the additional payment, as a percentage of the standard weekly repayment, the more significant the impact on interest paid. This is because a greater element of the extra payment will go towards paying off capital, reducing the interest charged. The additional payment also allows you to pay back the capital sooner hence the reduced number of payments.

Looking at the lower loan amount, finding an extra $10 a week throughout the loan would save 34% on interest charged. It would also reduce the loan term from three years to 2 years. This perfectly illustrates how to reduce debt quicker by making additional loan repayments.

Giving yourself headroom

When considering a loan, it is important not to overstretch your finances with regard to repayment terms and duration. There is often a natural endeavour to pay back your debts as soon as possible so that you can begin to rebuild your finances. Unfortunately, with the best will in the world, it isn’t easy to plan with any absolute confidence how your finances may pan out in the short to medium-term.

Consequently, if you take a cautious approach regarding loan repayments and the term of your loan, this can leave some additional room to make extra payments in the future. On the flip side, imagine the scenario, after experiencing a degree of financial difficulty, you have managed to negotiate debt consolidation funding. Determined to pay back the loan as quickly as possible, you commit to the maximum monthly repayment you can afford. However, after just a few payments, your insurance premiums go, household bills start to rise, and you struggle to find the funds to cover loan repayments.

Eventually, you begin to miss payments, charges and additional interest begin to stack up, and your financial situation goes from bad to worse. If you had given yourself that little bit of “headroom” when discussing the terms of your loan, this would have allowed you to absorb a degree of increased expenditure, without impacting your ability to cover loan repayments.

Talk to us

As a responsible lender, we appreciate the challenges many clients face with an unexpected cut in their regular income. However, if you can foresee financial difficulties on the horizon, it is vital that you act sooner rather than later. Once your finances begin to slip away, it can be difficult to regain control, which can impact all areas of your life. Therefore, the sooner you approach us to discuss your difficulties, the more options available and the less impact on your credit rating.

While we are a business, there is no benefit for our clients or ourselves in offering finance which is simply unaffordable for the customer. Aside from the range of different loans we offer, other options may be available, depending on your scenario. We won’t leave you high and dry, instead offering assistance where possible and making you aware of all available options.

Interest charges at Alternative Finance

As you will see on our website, when calculating interest charges, we do this on the following basis:-

“Interest charges are calculated by multiplying the unpaid balance at the end of the day by a daily interest rate. The daily interest rate is calculated by dividing the annual interest rate by 365. Interest is charged to your account fortnightly.”

The interest rate charged on your loan will depend upon your financial status and any collateral available. In general, interest rates range between 13.95% and 26.98% per annum with a traditional duration of up to 36 months. However, there is a degree of flexibility out-with the standard term, which we can discuss in more detail when looking at your financial scenario.

Summary

Over the years, we have seen many clients stretching their finance in the early days of a loan to reduce the term and rid themselves of debt as quickly as possible. While admirable, this may be a questionable strategy unless you are sure additional funds will become available in the future. Indeed it makes more sense to be a little cautious on the terms of your loan and give yourself some “headroom” as insurance against any unforeseen financial challenges in the future?

There is always the option to make extra payments as and when available, and as you can see from the above table, it will impact the duration of your loan and the interest paid. What may look like relatively minor tweaks at the time can have a significant impact in the longer term. More money in your pocket!