Rising Household Debt in New Zealand

Since the US mortgage crisis of 2008/9, which led to a worldwide financial crisis, economies worldwide have been buoyed by record-low base rates. This has encouraged lending on an unprecedented scale, both personally and in business, leading to record household debt in New Zealand. In addition, the Covid pandemic forced governments to increase deficits to support individuals and companies, thereby heaping more debt on New Zealand households.

Before we look at ways of tackling record household debt in New Zealand, it is essential to note that this is occurring worldwide. However, with the spectre of interest rates having bottomed out, demonstrated by the recent increase, many people are now looking at ways to improve how they manage money and, in some cases, consolidating debts. As a result, there will be a greater focus on personal finance as we advance, especially if further increases in interest rates are forthcoming.

Background to rising household debt in New Zealand

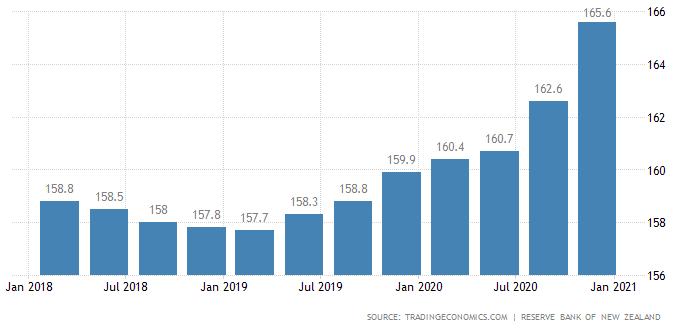

As you will see from the graph below, the Covid pandemic made an already difficult situation even worse with a sharp rise in household debt. Moreover, the problem is unlikely to have improved since the first quarter of 2021 where the debt-income ratio was 165.6%. It is only when you see these figures in black-and-white that the challenges become real.

New Zealand Household Debt to Income

Source: Trading Economics

US mortgage crisis of 2008/9

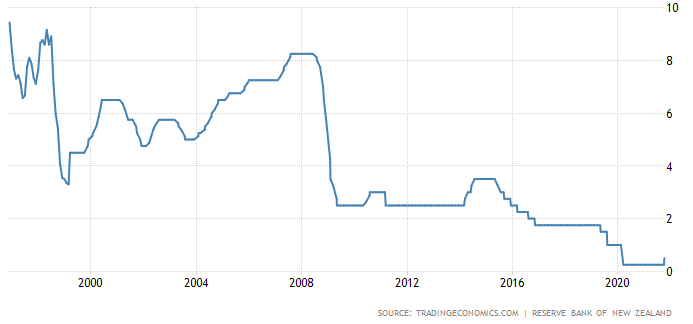

As we touched on above, the US mortgage crisis of 2008/9 had a massive impact on the worldwide economy. This led to a slashing of worldwide base rates, short term tightening of bank lending criteria and ultimately a worldwide recession. As you can see from the central bank base rate chart below, the ongoing recovery from the US mortgage crisis and the Covid pandemic is predominately based on cheap finance. However, inflation is now a real problem that has forced central banks worldwide to consider an increase in base rates.

Central bank base rates

For many years, New Zealand has reaped the rewards of a robust and prosperous economy. As you can see below, relatively high base rates were required to keep inflation in check and ensure that the economy did not “overheat”. In light of the 2008/9 US mortgage crisis, we saw a slashing of base rates from which there has only been a partial recovery. The latest New Zealand Central Bank meeting saw the base rate increase by 0.25% to 0.5%, the first increase since 2014.

As you can see from the graph, the current rate is nowhere near the average of the last 20 years. However, any increase in central bank base rates will impact the cost of mortgages, personal loans, credit cards and other types of finance. As a result, the cheap finance economy we have become used to over the last decade may be coming to an end.

Source: Trading Economics

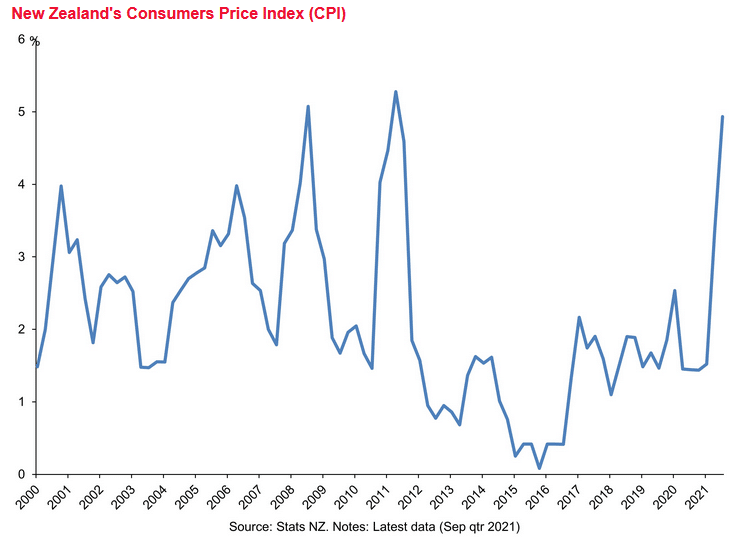

Inflation

Even though worldwide economies have been struggling since the US mortgage crisis of 2008/9, we have seen several spikes in the rate of inflation. This is reflected in the New Zealand Consumer Price Index (CPI) graph below, showing the ever-increasing cost of living. The recent spike to 5% comes at a time when interest rates are rising, creating something of a double whammy for consumers and businesses. The cost of living continues to increase; finance is becoming more expensive, creating a squeeze and forcing many to the precipice of financial trouble.

Source: Reserve Bank of New Zealand

Further pain ahead

At this moment in time, central banks worldwide, including the New Zealand central bank, are faced with a quandary. Inflation, currently fuelled by an increase in energy costs, is way too high. The bluntest means of reducing inflation is to limit access to finance, hence the recent rise in the New Zealand central bank base rate. Reducing access to finance will limit consumer spending and should eventually lead to a reduction in the rate of inflation. However, it looks as though there will be further pain ahead before the situation is resolved.

So, with many households facing unprecedented debt levels as a percentage of their income, what are the options available?

Consolidating debts

While it is very easy to bury your head in the sand and pretend that nothing is happening, you need to face any issues head-on. The recent, albeit relatively small, increase in interest rates will have a knock-on effect on the cost of loans and other types of finance. The average household in New Zealand is likely to have an array of finance including:-

• Personal loans

• Credit cards

• Mortgages

• Overdraft

The interest rate charged on these types of finance will likely vary quite dramatically. Credit cards and overdrafts tend to be relatively expensive, personal loans and mortgages less so, but this will depend on your financial status. As personal loans and credit cards are the most liquid financial instrument, this is where many people may encounter difficulties.

Consequently, there is a growing interest in the consolidation of debts. This is a process by which one new loan is used to repay, for example, personal loans and credit card debts. There are several benefits which include:-

• Only one minimum monthly repayment

• Potential to reduce the average interest rate/payments

• Extend loan term

The consolidation of debts allows you to restructure repayment terms. This may include extending the loan term, which would reduce monthly repayments, giving you a little more financial “headroom”. Here at Alternate Finance, we offer affordable debt consolidation options based upon your financial situation and ability to pay. As a responsible lender, we will be upfront and honest regarding your situation. If debt consolidation is not a possibility, we will advise you of the alternative options available to you.

Personal finances

When looking at your personal finances, it is essential to be honest, and upfront with yourself. Take a few moments to yourself; write down your regular income, debts, living costs and additional outgoings. Many people looking to improve how they manage money will be shocked and surprised at their financial situation. However, this is the first step on the road to recovery and will allow you to start planning ahead.

It is fair to say that personal finances and how we all manage money are very different. That said, there are many ways in which you can improve your finances by controlling your expenditure:-

Track your spending habits

One of the best ways to manage money is to track your spending habits and question expenditure which may not be essential. As many people use banking apps, you will probably be able to pull a list of your direct debits, standing orders and expenditure with different stores and companies. A great starting point!

Re-evaluate subscriptions

The chances are that you will have several subscriptions that you pay regularly, but you don’t necessarily make full use of. There will likely be some subscriptions that you can cancel when reviewing your personal finances, thereby saving money. The amounts may be small in isolation, but the cumulative impact of multiple savings can be significant.

Review insurance premiums

We all know that we should look elsewhere when renewing car, home and other types of insurance. But, how many of us do this? You will also find that one of the best ways to manage money when taking out insurance is to negotiate a bulk deal. As the vast majority of general insurers will offer home, car and other popular types of insurance, you should be able to negotiate a discount when taking out two or more policies.

Shop on a budget

When you walk into the major supermarkets, these companies are experts at placing “impulse purchase” products in the right place at the right time (wrong time for consumers!). Consequently, when looking to manage money spending in supermarkets, you should work from a list. This list should contain essentials, thereby reducing the temptation to buy products you don’t necessarily need. You will be surprised at the savings!

Take action sooner rather than later

When looking at consolidating debts, the major challenge is facing the problems in front of you. Before you sit down and write your income and expenditure on a piece of paper, you will likely already know that things are difficult. When you miss your first regular repayment, this is when things start to get challenging. You then end up “robbing Peter to pay Paul”, and the situation can nosedive quickly.

Here at Alternate Finance, we can advise you on the best way of consolidating debts to reduce financial pressure. For example, using a new loan to pay off all of your existing debts can often see a reduction in your average interest rate. There is also the opportunity to negotiate an extended loan term that would reduce your monthly repayments. Obviously, the longer the duration of your loan, the more interest you will be charged, but you may be able to refinance later as your finances improve.

If it is obvious your personal finances are suffering, and you need to review how you manage money, that is the time to look at consolidating debts. The longer you leave it, the worse your financial situation will become, which can sometimes reduce the options.

Summary

Household debt in New Zealand has increased significantly in recent years, in line with other countries worldwide. Many of us have become accustomed to this artificially low-interest-rate environment. While the recent 0.25% increase in New Zealand base rates was expected, this is likely to be the turning point, with further rises forecast in due course. Consequently, even if you are not yet feeling the financial pinch, it is sensible to review your personal finances.

If you are feeling the financial pinch and your personal finances are suffering, it is essential to look at different ways to manage money in the short, medium and longer term. For example, is it time to look at consolidating debts and taking back control?