Loans for people with bad credit

Are you struggling with a bad credit rating and mounting debts? Unable to focus on the long-term, it can be a case of fire fighting in the short term. There is a solution; there are ways to improve your credit rating while also managing your finances. The end of the tunnel is in sight, but you need to stay focused, keeping one eye on short-term finances and the other on long-term improvements. There is hope!

If you search the Internet for “loans for people with bad credit”, you will undoubtedly find an array of potential offers. They all have one thing in common, sky-high interest rates. While here at Alternative Finance, we don’t offer loans for those with bad credit, we do offer advice about improving your credit rating. You can take many actions, which in isolation will make a difference, but the cumulative impact of these actions can be life-changing. A path out of debt…………

Take control of your finances

When you are struggling financially, it can feel as though your debts and debt repayments are controlling your life. Many people feel stigmatised, under intense pressure, which can have a knock-on effect on their everyday lives. When looking to improve your credit rating, the first action is simple: list all of your debts and all of your income. For many people, this isn’t easy. For the first time in years, they will need to their head out of the sand. Reality can be harsh!

The more shocked you are about your finances, the more chance you will do something about it. Remember those days when you enjoyed receiving post, checking your email account in anticipation of good news and didn’t have to shuffle money between accounts to cover loan repayments. Those days are not far away.

So, where do you start?

Improving your credit rating

If you look back over the years, loans for people with bad credit tend to include significant penalties and additional interest for missed payments. It can become a case of “robbing Peter to pay Paul” as slowly it gets harder to cover monthly repayments and other charges. So, what can you do?

You must stop applying for new loans and new credit lines, as each application will require a review of your credit rating. The more loan applications you make, the higher the number of credit checks, and the more alarm bells start ringing. Nobody is suggesting there won’t be challenges in the short term, but it is essential to stop further deterioration in your credit rating.

Debt consolidation

The vast majority of those struggling with bad credit ratings will have an array of relatively small debts they are struggling to cover. When you consider minimum repayments, many people find it impossible to plan ahead and tend to live on a day-to-day basis. Rather than looking for new loans for people with bad credit, it is time to look at debt consolidation.

There are many benefits to debt consolidation, which include:-

- Consolidated your debts into one affordable monthly repayment

- Opportunity to adjust the duration of your repayment plan

- Removal of penalties from numerous debt facilities

These three benefits of debt consolidation will change your financial landscape for the future. They will give you hope, control and above all, a way out of long-term debt. Here we have our starting point.

Affordable monthly repayments

As we touched on above, if you have numerous debt facilities, perhaps you owe money on utilities and various loans; each will require a minimum monthly repayment. These monthly payments often add up to a figure which is quite simply unaffordable. A debt consolidation loan would see all of your debts repaid, leaving just one loan and one monthly repayment. You must close down the old loan accounts, thereby removing the temptation to borrow more in the future.

Adjust the duration of your repayment plan

With any debt, there is a natural tendency to want to repay it as quickly as possible. That is perfectly understandable but, unfortunately, probably not practical in the early days. You mustn’t commit all of your free income to relatively large monthly payments on your debt consolidation loan. In this scenario, an unexpected expense in the future could leave you short, behind on payments and incurring additional interest and penalties again. The very things you are striving to escape!

Consequently, it is sensible to extend your loan over a period that gives you a little extra cash at the end of each month. This can be saved and used in the event of unexpected expenses in the future without putting your monthly repayments at risk. While these are relatively small practical steps, they are great strides in your long term financial recovery.

Reducing your available credit

Consolidating your loans will make a massive difference to your long-term financial health. Indeed, it will make a huge difference to your short-term mental health as at least some of the pressure is lifted. However, this is just the start of the journey.

As you become more comfortable with your new loan monthly payment, there can be a temptation to spend that little extra. In reality, at this point, you should reduce your credit lines to remove any degree of temptation. It was probably those credit cards, store cards and other debt vehicles which contributed to your initial financial distress. There is no shame in learning from your mistakes!

Controlling credit card spending

We know that many people will cling tightly to their credit cards, even during the worst of their financial distress. Even though excessive credit card spending for many people signalled the start of their financial problems, they can offer something of a comfort blanket. However, once you have repaid your credit card debt with a debt consolidation loan, it is time to take a look at your credit limit!

It can be helpful to have a credit card to hand, but you should consider reducing your limit to the bare minimum. That way, it will not become a debt building machine and more of an emergency credit line. While traditionally, many people will look to increase their credit card limit, and open a new bank account, as a means of improving their credit rating, we are focused on stopping further deterioration.

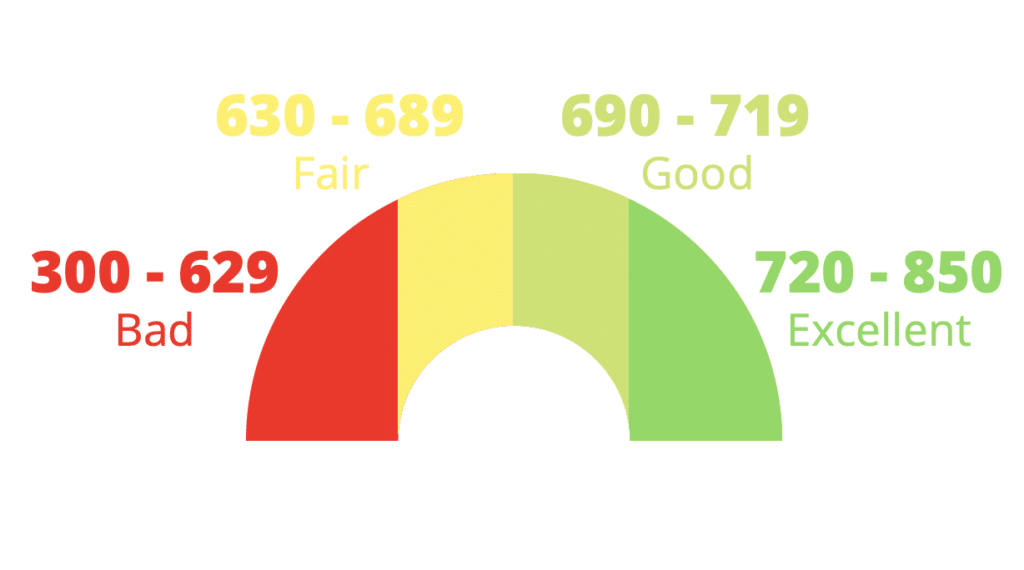

Monitor your credit rating

There is no doubt that the financial services industry has benefited more than most from the online revolution. There is the ability to check the full range of financial services 24/7 at your convenience. This has also brought the credit rating companies into focus, with many offering an online monitoring service. This allows you to monitor your credit rating regularly, provides an alert to significant changes, and a degree of help and guidance. As your long-term goal is to improve your credit rating, eliminating the need to apply for loans for people with bad credit, make use of these services.

Unfortunately, while the credit rating system in New Zealand is relatively advanced and well-established, errors do still occur. By monitoring your credit rating regularly, you will very quickly be alerted to any omissions and errors. As soon as you see a problem with your credit rating, maybe a credit facility added to your account in error, approach the credit rating agencies. Explain your situation and ask them to rectify it as soon as possible.

PPSR searches

You may have come across the Personal Property Securities Register (PPSR), which lists companies that hold a registered security against you. Even though the service is normally kept up-to-date, issues and delays can emerge. It is advisable to check the PPSR regularly (perhaps when you undertake your annual financial review) to ensure everything is correct. There will be no issues in the vast majority of cases, but there is no harm in checking!

Correcting errors

Even though the wheels of finance tend to move pretty quickly, you will, from time to time, find errors and omissions when it comes to financial records and credit ratings. This is why you must monitor your credit rating regularly. If you see an error, or perhaps an entry that you don’t recognise, contact the credit rating agency as soon as possible. Imagine the scenario; you have taken on a debt consolidation loan, spent years resurrecting your credit rating only to find records out of date, and your new loan application rejected.

Looking to the long-term

If you’re expecting to turn around your challenging financial situation overnight, you will likely be disappointed. While deterioration in your finances may see you in financial difficulties reasonably quickly, the path to recovery tends to be much longer. It is crucial to reduce your spending and also reduce the temptation to use credit cards. At the heart of a debt consolidation loan are the monthly repayments and the duration. Please make sure they are affordable!

It is only when you finally emerge from the shadow of financial distress that you appreciate the impact this can have. Research shows that financial pressure can lead to not only health issues but also relationship issues. So, when you begin tackling your financial challenges, you are not only targeting an improvement in your financial health but also your physical and mental well-being.

Conclusion

While here at Alternate Finance, we don’t offer loans for people with bad credit ratings, we can still provide priceless long term advice. In isolation, the various actions you can take to repair your finances may seem small, but put them together, and they can be life-changing. Challenges can be problematic in the early days, but if you maintain focus on the long-term goal, it is undoubtedly worth it.

As your credit rating gradually improves, so will your access to finance at affordable interest rates. Eventually, you should be able to refinance your debt consolidation loan on significantly reduced interest rates. You can breathe again…..