How is interest calculated on a loan?

In this blog article, we’re going to take a look at the math behind interest and how it works on your loans. Knowing the basics will help you make educated decisions when you’re looking for a loan to help with your finances.

What is interest?

Interest is the amount of money that a lender charges a borrower for the use of their money. The interest rate is the percentage of the loan that the borrower will pay in interest. The term “interest” can also refer to the amount of money that an investor earns on their investment.

Calculating Interest

Interest on a loan is calculated based on the amount of money borrowed, the length of the loan, and the interest rate. The interest rate is the percentage of the loan that is charged for borrowing the money.

The amount of interest that you will pay on a loan depends on three things:

1) how much money you borrow

2) the length of your loan

3) the interest rate

How is Compound Interest Calculated?

When it comes to loans, interest is typically calculated in one of two ways: simple interest or compound interest. With simple interest, the borrower pays a set amount of interest on the principal loan amount for the entire term of the loan. For example, if you take out a $100 loan with a 5% simple interest rate and a two-year repayment period, your total interest payments would be $5.

With compound interest, the borrower pays interest on both the principal loan amount and any accumulated unpaid interest from previous periods. This means that the longer you take to repay your loan, the more interest you will end up paying. For example, if you take out a $100 loan with a 5% compound interest rate and a two-year repayment period, your total interest payments would be $10.52

While compound interest may seem like a better deal for the lender, it can actually work in favor of the borrower if they plan to repay their loan early. This is because reducing the balance of the principal loan means that less overall interest will calculated and less will be paid overtime.

Amortized Loan Payments

The interest on a loan is calculated based on the amount of the loan, the term of the loan, and the interest rate. The interest rate is usually expressed as an annual percentage rate (APR).

The amount of interest you pay each week/month is determined by your loan’s amortization schedule. An amortization schedule is a table that shows how much of your monthly payment goes toward principal and how much goes toward interest.

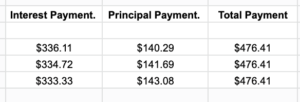

As an example, let’s say you have a $100,000 loan with a 4% APR and a 30-year term. Your monthly payment would be $477.42, and the amortization schedule would look like this:

As you can see from the table, the bulk of your early payments go toward interest rather than principal. In the early years of your loan, you’re essentially paying for the privilege of borrowing money. But as time goes on and you pay down more of your principal balance, your payments become increasingly focused on principal reduction until, in the later years of your loan, most of your payment is going toward reducing what you owe.

Interest Rate Formula

The interest rate on a loan is the cost of borrowing the money, and is typically expressed as a percentage of the total loan amount. The interest rate can be calculated in several different ways, but the most common method is to simply take the annual percentage rate (APR) and divide it by the number of payments you will make over the life of the loan.

For example, if you have a $100,000 loan with a 4% APR and you will make monthly payments for 30 years, your interest rate would be:

4% APR / 12 months = 0.33% per month

0.33% per month x 30 years = 9.9% total interest paid

If you have a variable interest rate loan, your interest rate may change over time based on market conditions. In this case, your monthly payment would also change, so be sure to budget accordingly.

Summary

If all of this math does your head in, and it’s hard to understand, then please reach out to ask questions about your business finance, or personal loans. We’re happy to run you through it so you can get a clearer understanding.